crypto tax calculator canada

Web The step-by-step guide to calculating cryptocurrency tax in Canada. Web We offer a free trial so you can try out our software and get comfortable with how it works.

Crypto Com Tax Tool Review 2022 Free Tax Calculator By Crypto Com

If for instance you earn 1000 through crypto trading and your tax rate is 25 youll end up with a tax bill of 125 on those funds or.

. A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes. Web First sign up with the crypto tax calculator of choice and select your country and currency. Once youve entered your capital.

Web Crypto Tax Calculator. Web Heres how you calculate crypto taxes in Canada. The free trial allows you to import data review transactions see a full breakdown of.

NFT Support Track all of your NFT trades. This means you average all your holdings to figure out the purchase price of sold assets. Web To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat.

It takes less than a minute to sign up. Capital GainCapital Loss Gross Proceeds - Cost Basis. Web You have to use the Adjusted Cost Basis for calculating your crypto taxes.

Web Our free tool calculates your capital gains through the following formula. On the crypto transaction of 20000 you will pay tax on 10000 at a rate of 33. The first step in calculating cryptocurrency tax in Canada is to figure out how much you earned.

Web And by that we mean at a higher rate. Web However lets say the capital gains tax rate for your bracket is set at 33. Web Regarding taxes half of your capital gains will be subject to taxes.

The best tax apps for Canada support. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Web For example if you have made capital gains amounting to 20000 in a certain year only 10000 will be subject to capital gains tax.

The source data comes from a set of trade logs which are provided by. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to. For example you bought any crypto for 20000.

Next select your accounting method. Web Guide for cryptocurrency users and tax professionals. Web Were here to help you with your crypto taxes.

FMV Fair Market Value Cost Basis Capital GainsIncome Fair market value is the amount the asset or crypto. By the end of the year the price of your. Web Youll then consider capital gains taxes on 2000 profit.

Your tax authority wants to know your equivalent profits or. Web Create your free account now. Reach out to us today.

There are some instances.

Crypto Tax And Portfolio Software Cointracker

Best Crypto Tax Calculator Canada In 2022 Skrumble

9 Best Crypto Tax Software Apps 2022

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

The Investor S Guide To Canada Crypto Taxes Coinledger

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

9 Best Crypto Tax Software Apps 2022

11 Best Crypto Tax Calculators To Check Out

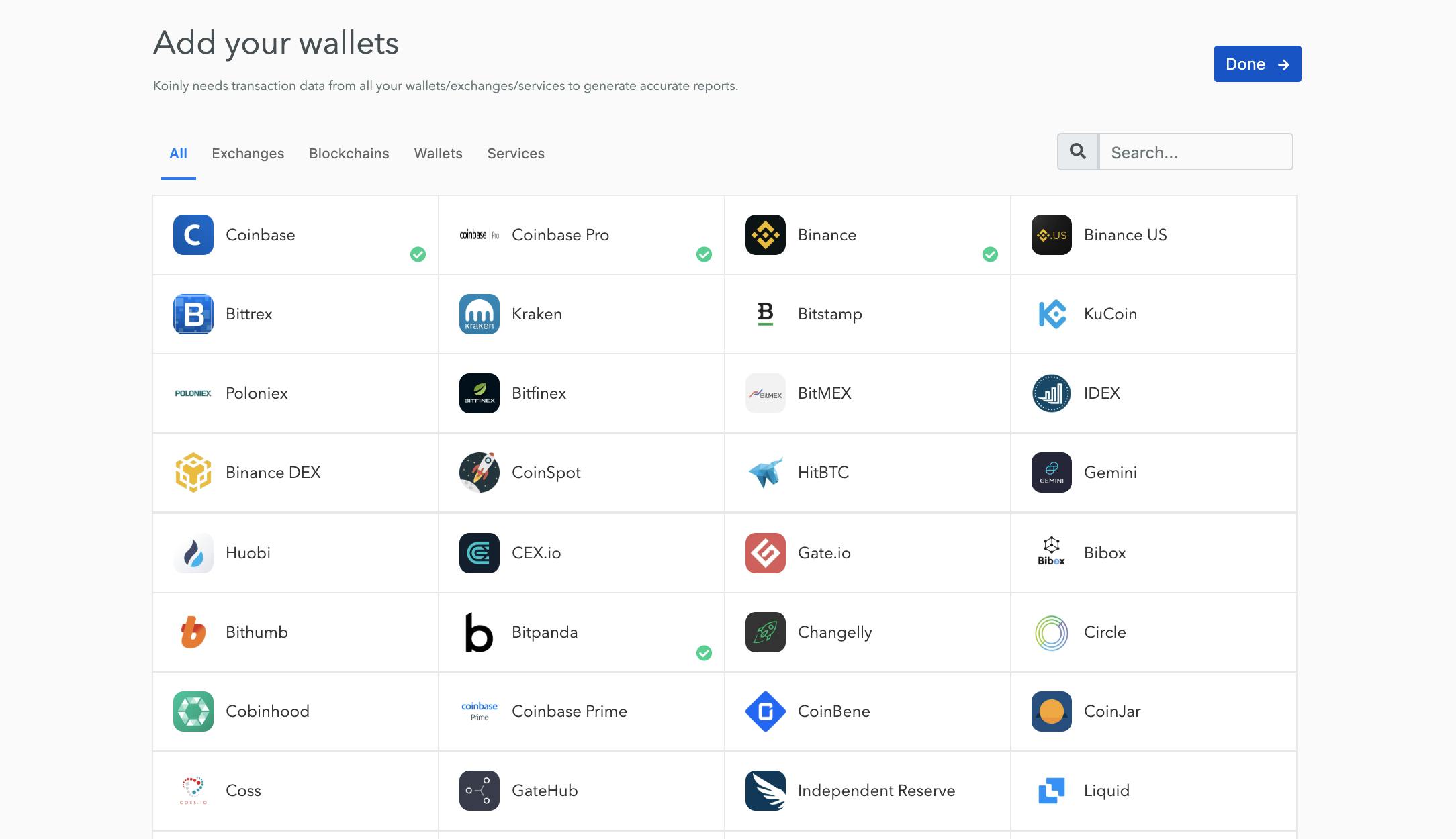

Koinly Bitcoin Tax Calculator For Canada

10 Best Crypto Tax Software In 2022 Top Selective Only

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Koinly Vs Zenledger 2022 Is Zenledger Better Than Koinly

Calculate Your Crypto Taxes Using The Formulae Below Or Simply Use My Automated Software Hackernoon

Koinly Bitcoin Tax Calculator For Canada

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Free Crypto Tax Calculator 2022 Online Tool Haru

How To Report Crypto Taxes In 2022 Crypto Tax Calculator Sweden And Works In 35 Countries Airlapse

![]()

Best Crypto Tax Calculator Canada In 2022 Skrumble

Crypto Taxes How To Video Guide Free Excel Sheet R Bitcoinca